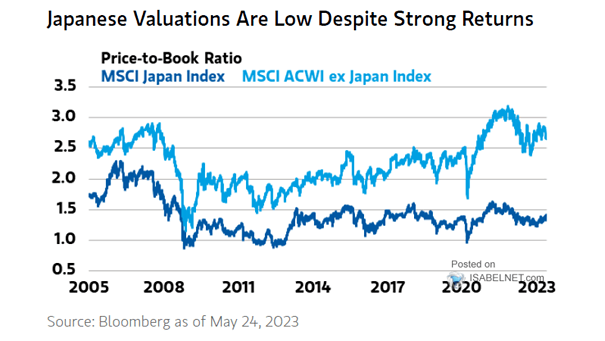

Valuation – Price-to-Book Ratio – MSCI Japan Index vs MSCI ACWI ex Japan Index

Valuation – Price-to-Book Ratio – MSCI Japan Index vs MSCI ACWI ex Japan Index Warren Buffett’s positive view on Japanese stocks has raised the question of whether it is the right time to consider investing in them. Image: Morgan Stanley Wealth Management