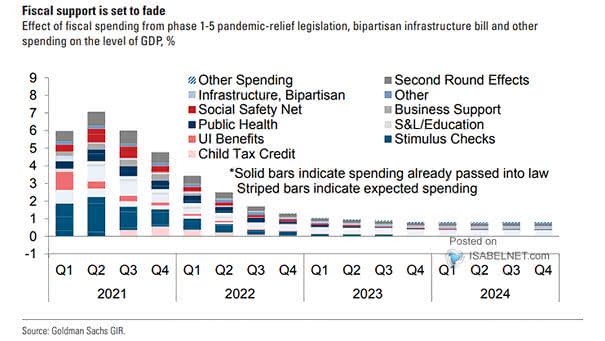

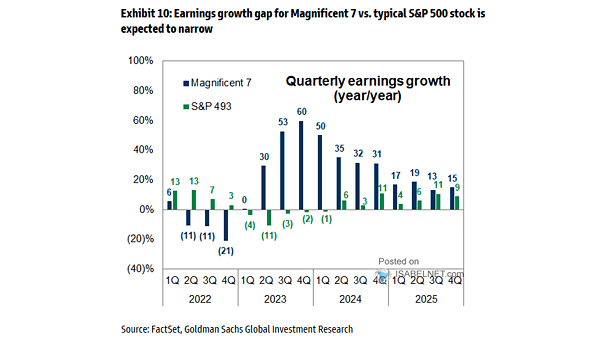

Fiscal Impulse to Growth from New Fiscal Legislation in the U.S.

Fiscal Impulse to Growth from New Fiscal Legislation in the U.S. Early 2026 may deliver a fiscal tailwind for the U.S. economy as the One Big Beautiful Bill Act kicks in, lifting household spending, business investment, and overall growth. Image: Goldman Sachs Global Investment Research