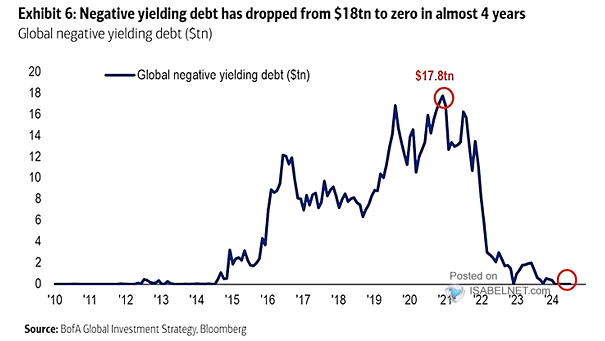

Global Negative Yielding Debt

Global Negative Yielding Debt The transition from $18 trillion to zero in negative-yielding debt over the past few years reflects a broader shift away from the era of ultra-low interest rates and easy monetary policy. Image: BofA Global Investment Strategy