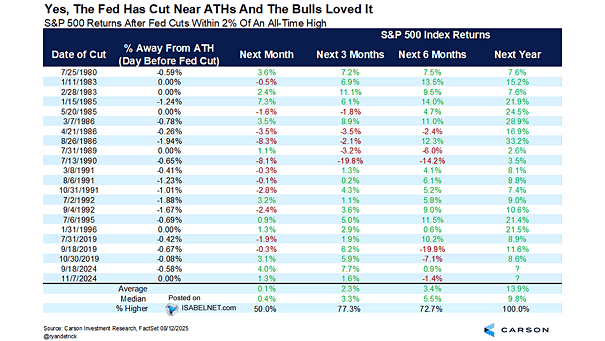

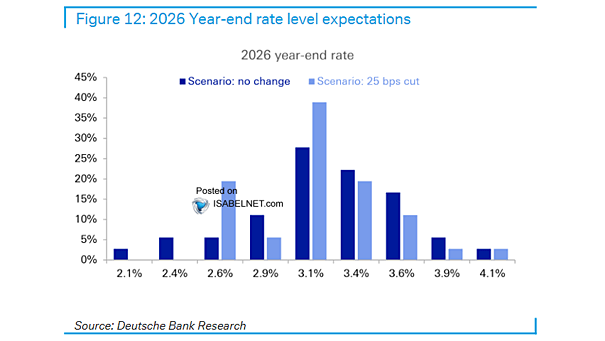

S&P 500 Returns After Fed Cuts Within 2% of an All-Time High

S&P 500 Returns After Fed Cuts Within 2% of an All-Time High Bears are losing ground as history leans bullish. Since 1980, when the Fed has eased policy while the S&P 500 traded within 2% of an all‑time high, the index has risen every time in the next 12 months, averaging a 14.2% gain Image:…