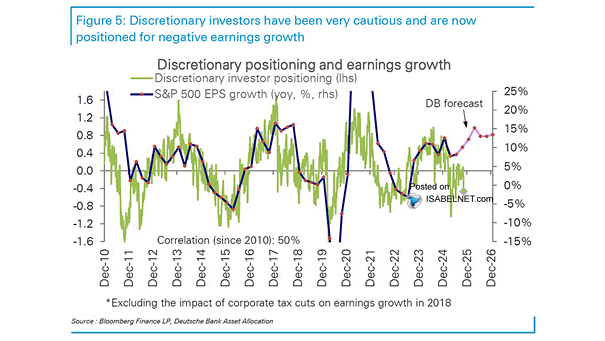

Discretionary Investors Equity Positioning vs. S&P 500 EPS Growth

Discretionary Investors Equity Positioning vs. S&P 500 EPS Growth Discretionary investors are bracing for a sharp slowdown in earnings growth that’s increasingly hard to square with the data. If that gloom lifts, risk appetite could snap back and drive equities higher. Image: Deutsche Bank Asset Allocation