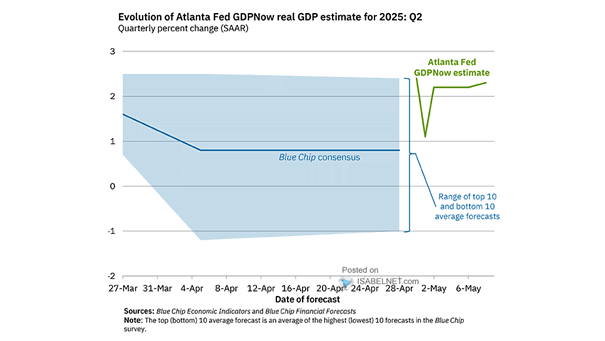

Atlanta Fed GDPNow U.S. Real GDP Estimate

Atlanta Fed GDPNow U.S. Real GDP Estimate Estimates from the Atlanta Fed’s GDPNow point to 3.9% annualized GDP growth in Q3 2025, a reminder that the U.S. economy isn’t cooling just yet. Image: Federal Reserve Bank of Atlanta