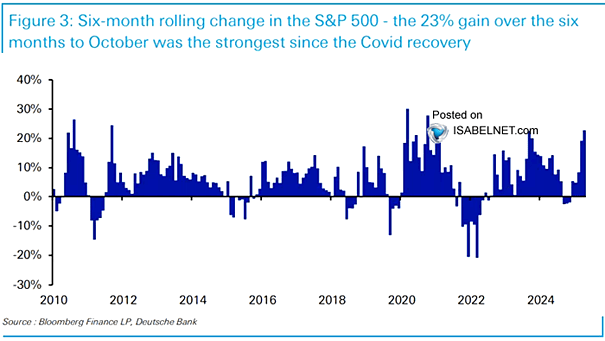

Rolling 6-Month % Change in the S&P 500

Rolling 6-Month % Change in the S&P 500 Following a six-month rally that sent the S&P 500 soaring 23% through October 2025, investors are beginning to wonder if the market still has fuel in the tank. History suggests sustaining this pace won’t be easy. Image: Deutsche Bank