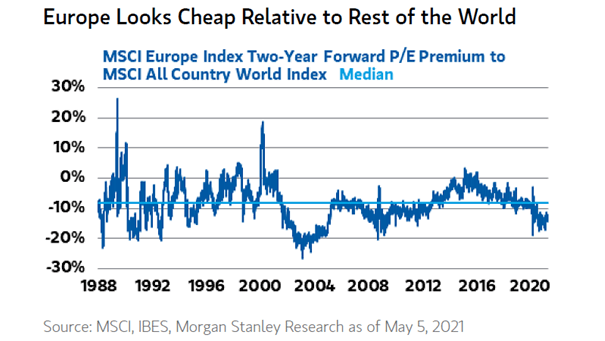

European Stocks – MSCI Europe Index Two-Year Forward P/E Premium to MSCI All Country Worl Index

European Stocks – MSCI Europe Index Two-Year Forward P/E Premium to MSCI All Country Worl Index European stocks remain cheap relative to their global peers. Image: Morgan Stanley Wealth Management