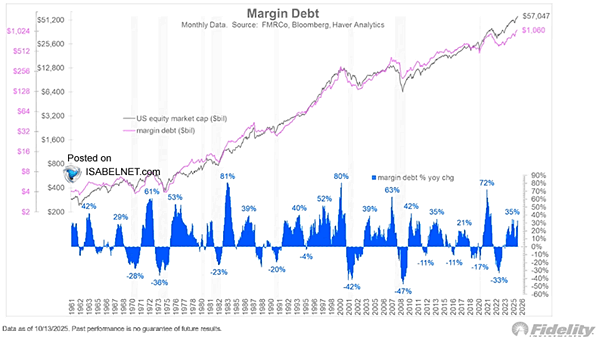

S&P 500 and Margin Debt

S&P 500 and Margin Debt Now above $1 trillion, margin debt stands at just about 1/57th of the total U.S. equity market cap, up 35% from a year ago—still a far cry from the surges seen at past bubble highs. Market tone feels alert, not alarmed. Image: Fidelity Investments