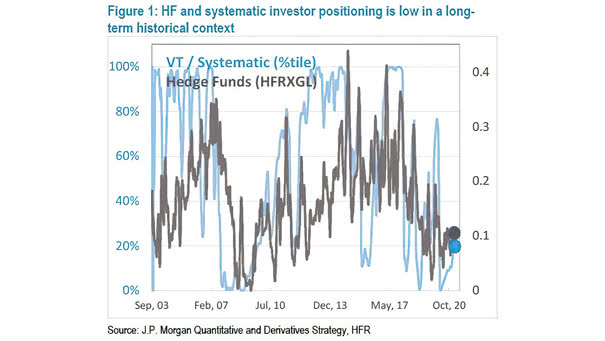

Hedge Funds and Systematic Investor Positioning

Hedge Funds and Systematic Investor Positioning Hedge funds and systematic investor positioning is low in a long-term historical context. Is any market pullback a buying opportunity? Image: J.P. Morgan Quantitative and Deratives Strategy