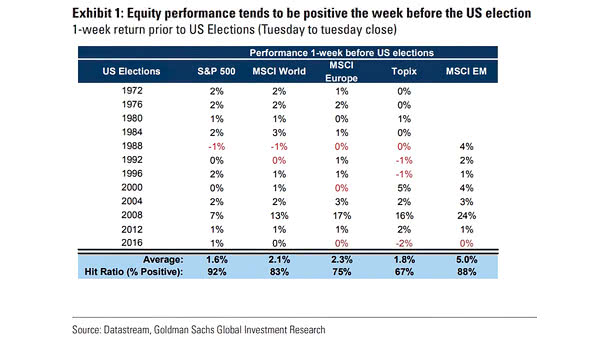

Equity Performance 1-Week Before U.S. Elections

Equity Performance 1-Week Before U.S. Elections Historically, the S&P 500 tends to be positive one week prior to U.S. elections (Tuesday to Tuesday close). Image: Goldman Sachs Global Investment Research