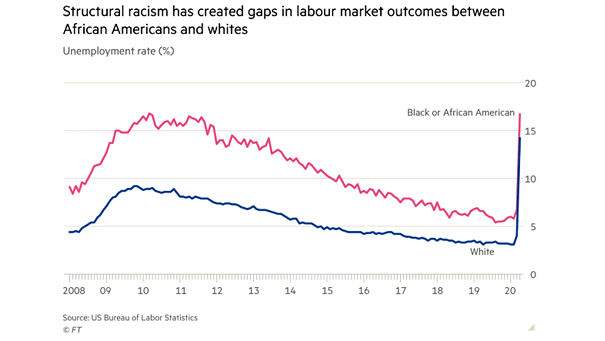

U.S. Unemployment Rate and Inequality: African Americans vs. Whites

U.S. Unemployment Rate and Inequality: African Americans vs. Whites This chart highlights the large gap between the African Americans and whites unemployment rates in the United States. Image: Financial Times