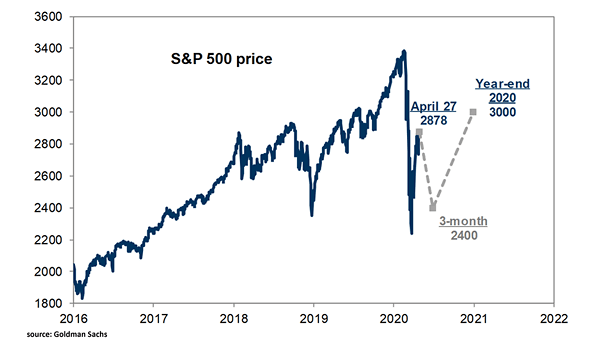

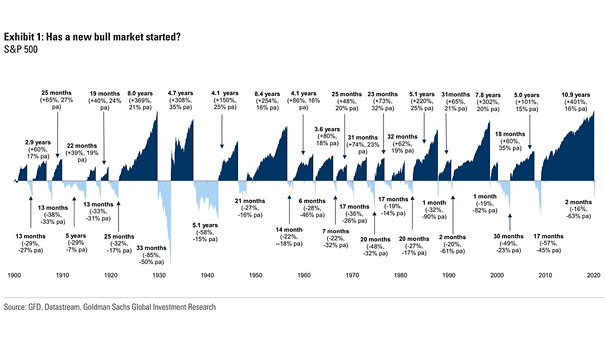

Forecast – New Path of the S&P 500 Market in 2020

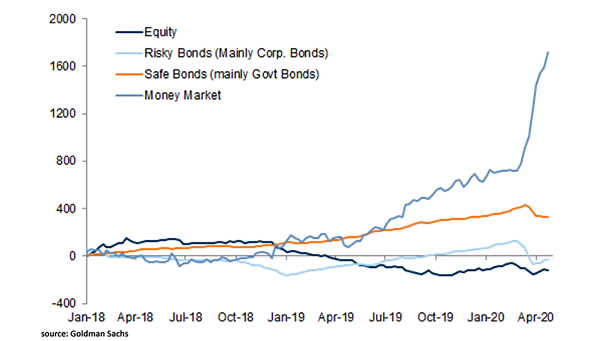

Forecast – New Path of the S&P 500 Market in 2020 Goldman Sachs has set a price target of 3000 by the end of 2020, and a new mid-year S&P 500 target of 2400. Image: Goldman Sachs Global Investment Research