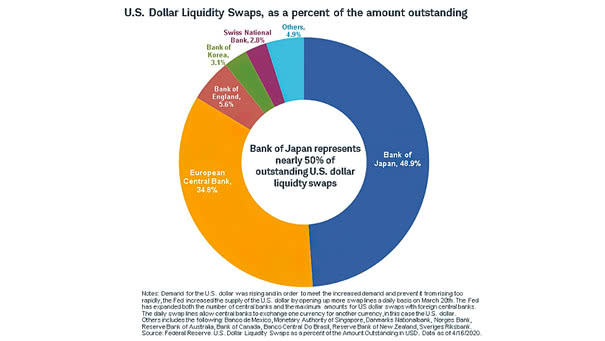

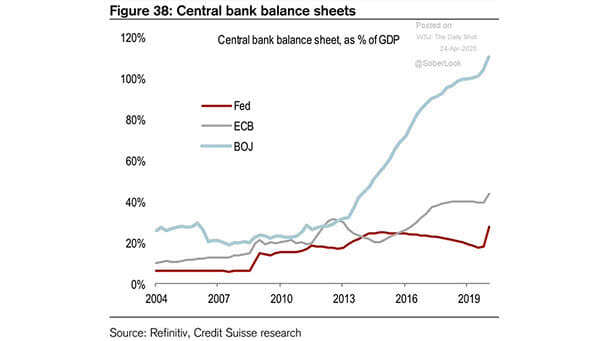

U.S. Dollar Liquidity Swaps, as a Percent of the Amount Outstanding

U.S. Dollar Liquidity Swaps, as a Percent of the Amount Outstanding The Bank of Japan represents nearly 50% of outstanding U.S. dollar liquidity swaps, a much higher rate than any other central bank. Image: Charles Schwab