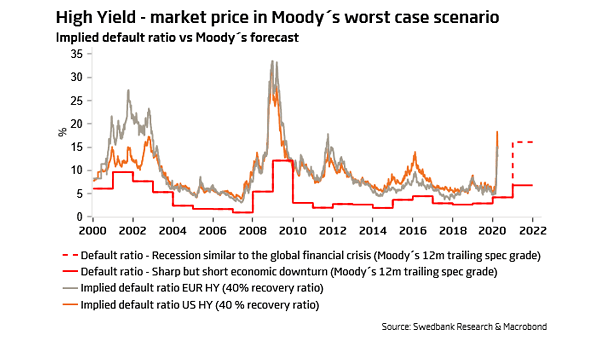

High Yield Spreads – Implied Default Ratio vs. Moody’s Forecast

High Yield Spreads – Implied Default Ratio vs. Moody’s Forecast High-yield spreads suggest a severe recession similar to the global financial crisis. Default ratio at 16.1% (12m). Image: Swedbank Research