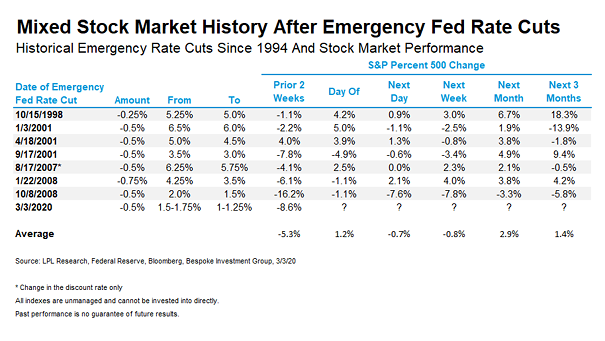

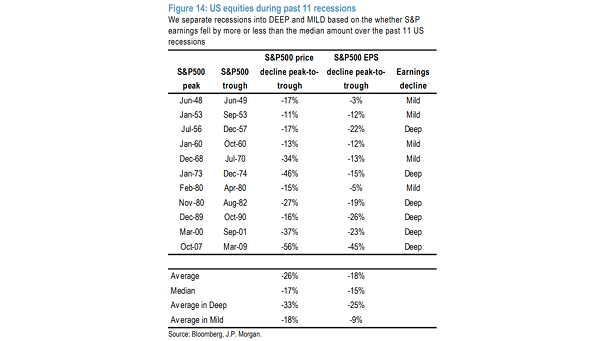

Historical Emergency Rate Cuts since 1994 and Stock Market Performance

Historical Emergency Rate Cuts since 1994 and Stock Market Performance After emergency rate cuts, the table shows that the performance of the S&P 500 has been mixed. Image: LPL Research