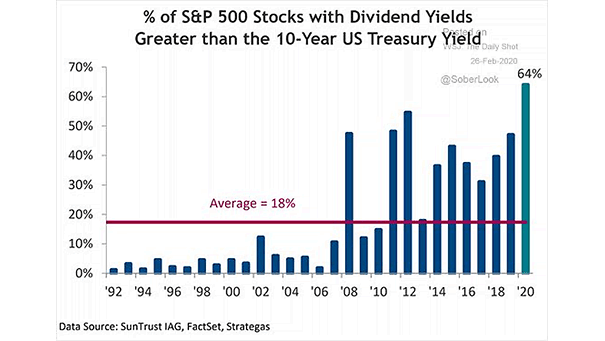

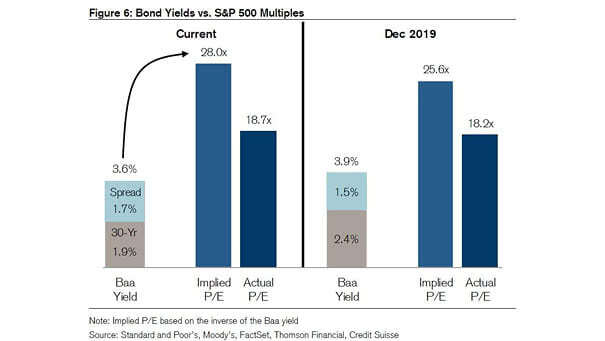

% of S&P 500 Stocks with Dividends Yields Greater than the 10-Year Treasury Yield

% of S&P 500 Stocks with Dividends Yields Greater than the 10-Year Treasury Yield Dividend yields on S&P 500 stocks seem competitive vs. U.S. Treasuries, but equity risk does not disappear because a company pays a dividend. Image: Truist