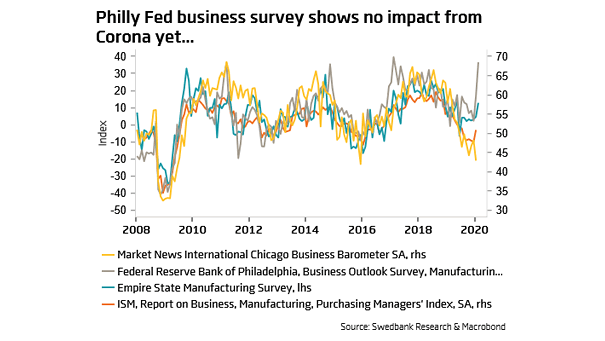

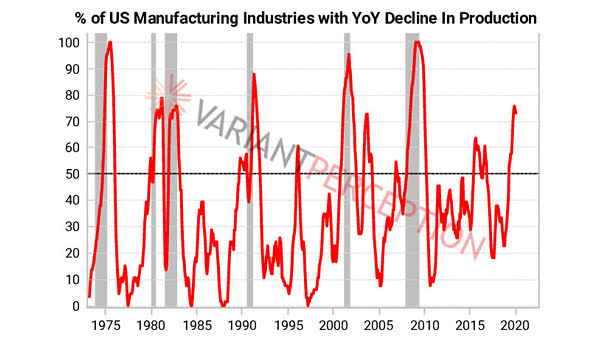

Philly Fed Manufacturing Index and Empire State Manufacturing Survey and ISM Manufacturing Index

Philly Fed Manufacturing Index and Empire State Manufacturing Survey and ISM Manufacturing Index Despite the coronavirus, both regional PMIs suggest an increase in U.S. ISM manufacturing this month. Image: Swedbank Research