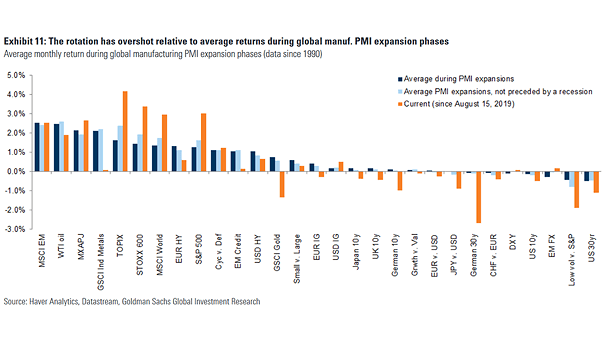

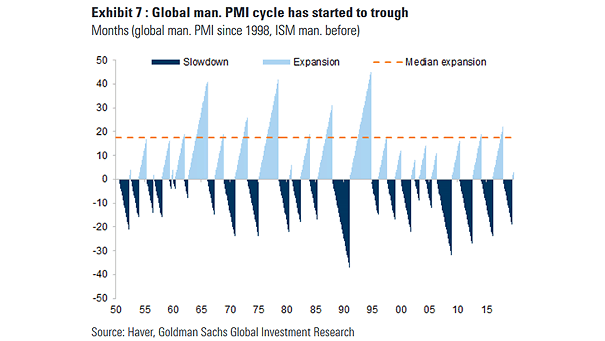

Average Monthly Return During Global Manufacturing PMI Expansion Phases

Average Monthly Return During Global Manufacturing PMI Expansion Phases Since August 15 2019, the rotation performance has been higher than average during global manufacturing PMI expansion phases. Image: Goldman Sachs Global Investment Research