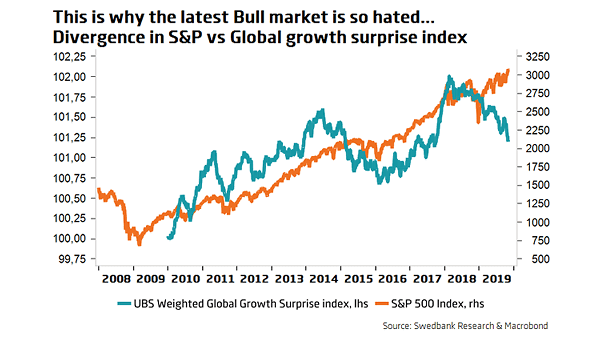

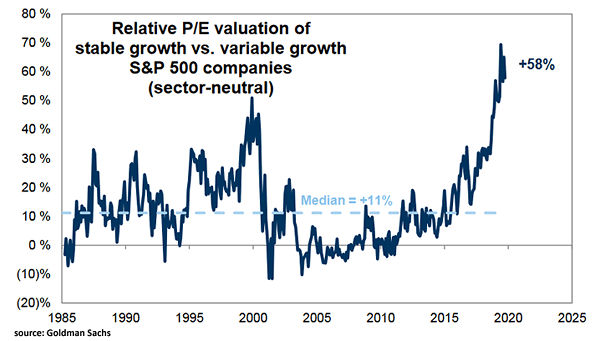

S&P 500 Index and UBS Weighted Global Growth Surprise Index

S&P 500 Index and UBS Weighted Global Growth Surprise Index The divergence between the S&P 500 Index and the global growth surprise index could explain why this bull market is so hated. Image: Swedbank Research