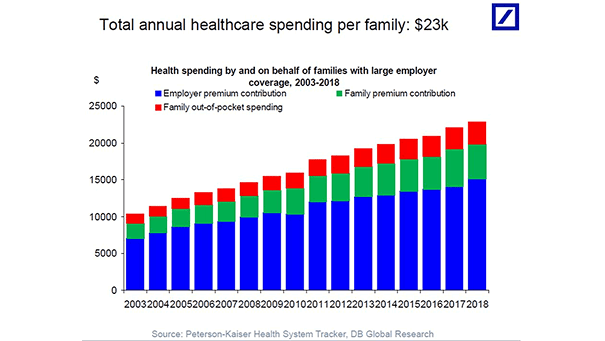

Total Annual Health Care Spending Per U.S. Family

Total Annual Health Care Spending Per U.S. Family Headlines say there’s no inflation, but U.S. health care costs have skyrocketed. The annual health care cost for U.S. families is $23,000 vs. $10,000 in 2003. Image: Deutsche Bank Global Research