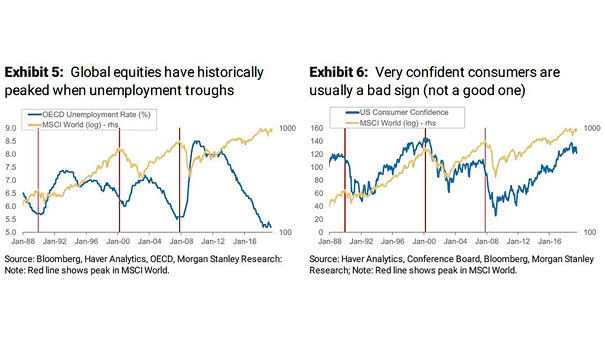

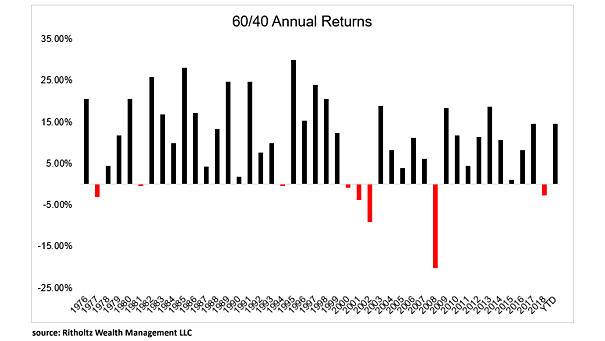

MSCI World Index vs. OECD Unemployment Rate and U.S. Consumer Confidence

MSCI World Index vs. OECD Unemployment Rate and U.S. Consumer Confidence Chart suggesting that OECD unemployment troughs and very confident U.S. consumers do not generally bode well for global equities. Image: Morgan Stanley Research