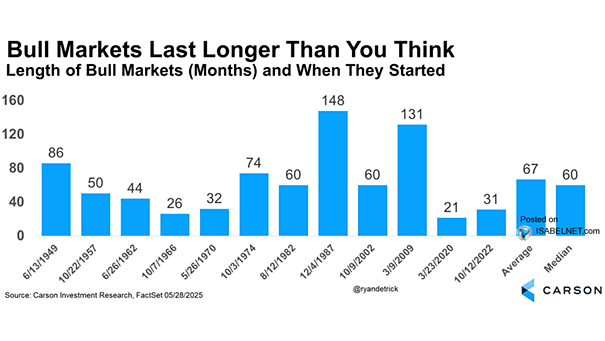

Length of Bull Markets and When They Started

Length of Bull Markets and When They Started The current bull market, which began in October 2022, remains relatively young by historical standards and could persist much longer than bearish observers expect. Image: Carson Investment Research