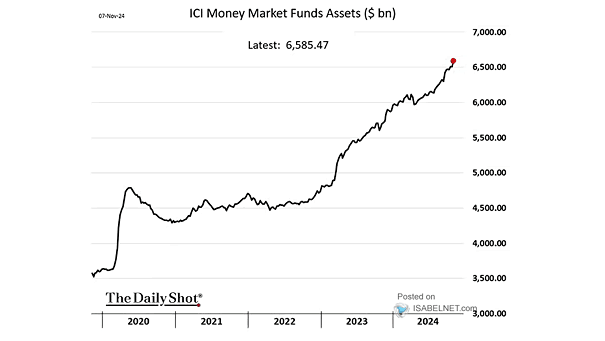

Money Market Fund Assets

Money Market Fund Assets While the $7 trillion in money market funds is frequently cited as potential fuel for equities and risk assets, most evidence suggests this cash is primarily a result of yield optimization and prudent cash management. Image: Bloomberg