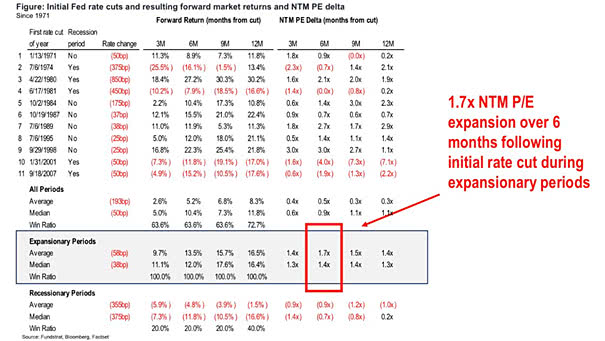

Initial Fed Rate Cuts and Resulting Forward Market Returns

Initial Fed Rate Cuts and Resulting Forward Market Returns This spreadsheet also shows that the S&P 500 has performed well on average, around first Fed rate cut. Image: Fundstrat Global Advisors, LLC