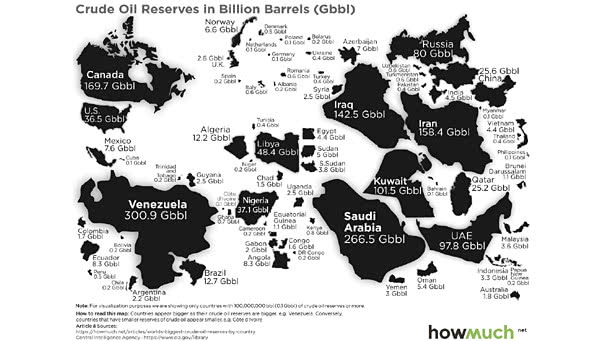

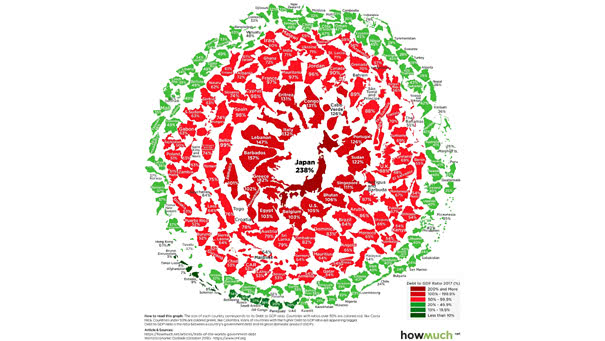

Crude Oil Reserves in Billion Barrels (Gbbl)

Crude Oil Reserves in Billion Barrels (Gbbl) The proven oil reserves in Venezuela are recognized as the largest in the world, but by some measures, it is the most miserable economy in the world. Image: howmuch.net