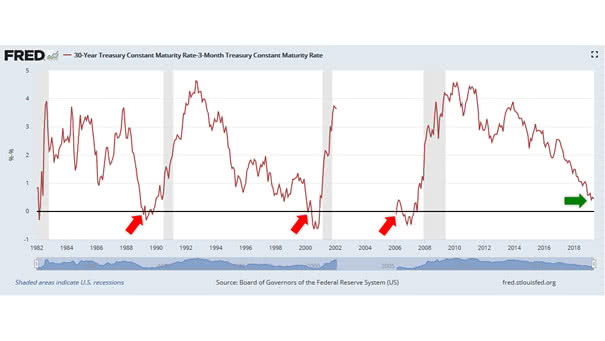

One of the Best Yield Curves to Predict a Recession is Coming

One of the Best Yield Curves to Predict a Recession is Coming The spread between the 30-year and the 3-month treasury yields is one of the best recession signal of all the yield spreads. In recent history, a recession occurs about 12 to 18 months after the yield curve inverts. When an inverted yield curve…