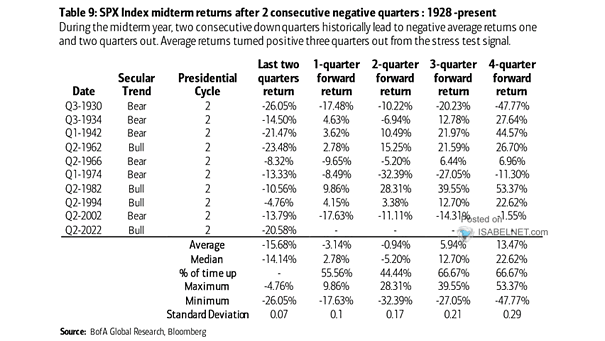

S&P 500 Index Midterm Returns After Two Consecutive Negative Quarters

S&P 500 Index Midterm Returns After Two Consecutive Negative Quarters During the midterm year, two consecutive negative quarters tend to lead to negative average returns one and two quarters out. Image: BofA Global Research