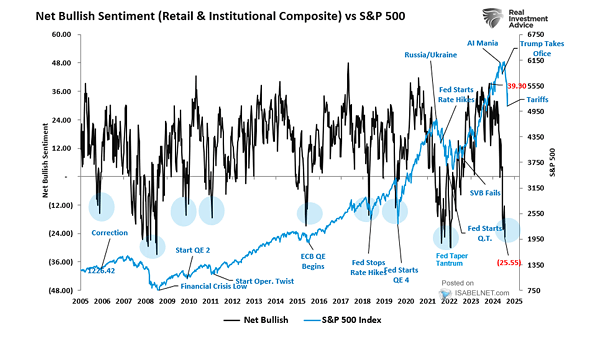

Sentiment – Net Bullish Ratio vs. S&P 500 Index

Net Bullish Sentiment vs. S&P 500 Index The net difference between bulls and bears reflects the overall sentiment and suggests a temporary pullback within a bullish market trend. Image: Real Investment Advice