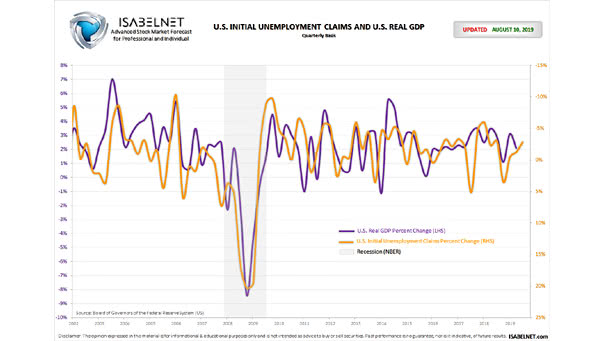

U.S. Initial Unemployment Claims and U.S. GDP

U.S. Initial Unemployment Claims and U.S. GDP There is a pretty good correlation between U.S. initial unemployment claims and U.S. GDP. Initial unemployment claims could suggest an acceleration of U.S. GDP in Q3 2019. Click on the Image to Enlarge