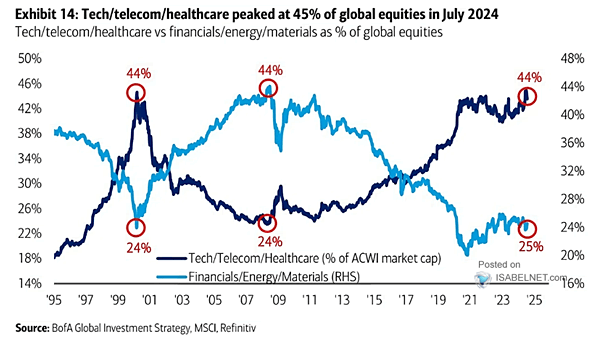

Energy and Financials Stocks vs. Healthcare and Tech Stocks

Tech/Telecom/Healthcare vs. Financials/Energy/Materials as % of Global Equities Should long-term investors consider buying the dip in sectors such as Financials, Energy, or Materials? Image: BofA Global Investment Strategy