Concentration – Top 10, Top 3 and Top 1 as % of Total (In Terms of Total Equity Market Capitalization)

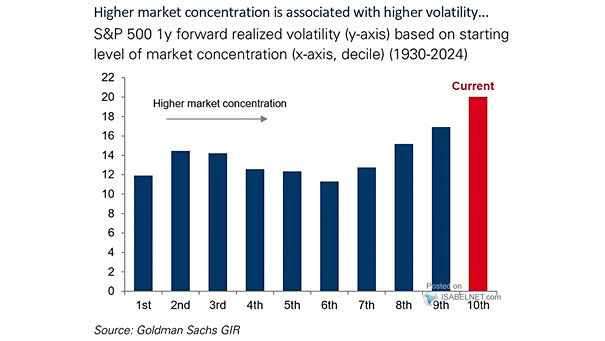

Concentration – Top 10, Top 3 and Top 1 as % of Total (In Terms of Total Equity Market Capitalization) China has one of the lowest market capitalization concentrations worldwide, with its top ten companies comprising only 17% of total market cap—much less than the US’s 34%—indicating greater growth potential in China. Image: Goldman Sachs…