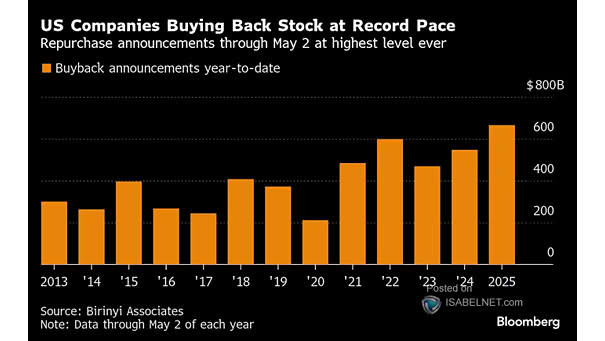

Buyback Announcements

Buyback Announcements In 2025, U.S. companies are announcing record levels of share buybacks, aiming to return cash to shareholders, stabilize stock prices, and enhance EPS as they navigate economic and policy uncertainty. Image: Bloomberg