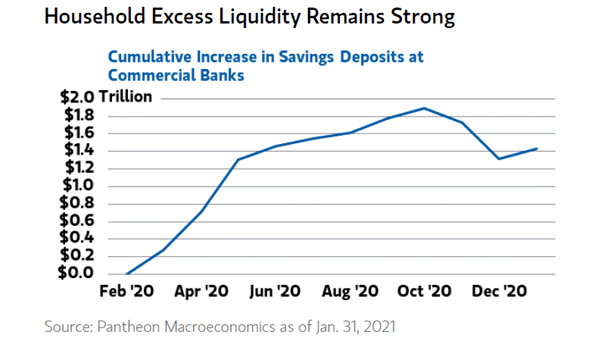

Cash – Cumulative Increase in Savings Deposits at Commercial Banks

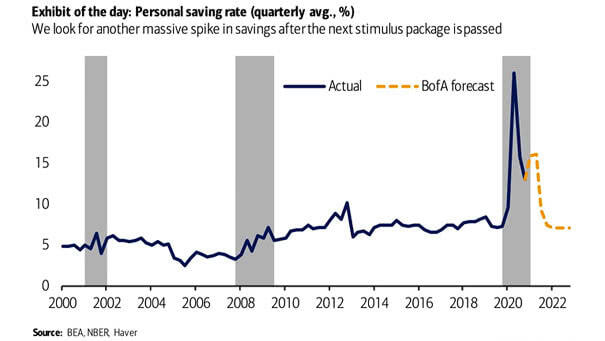

Cash – Cumulative Increase in Savings Deposits at Commercial Banks Household excess liquidity remains strong. Is it a contrarian bullish signal for stocks? Image: Morgan Stanley Wealth Management