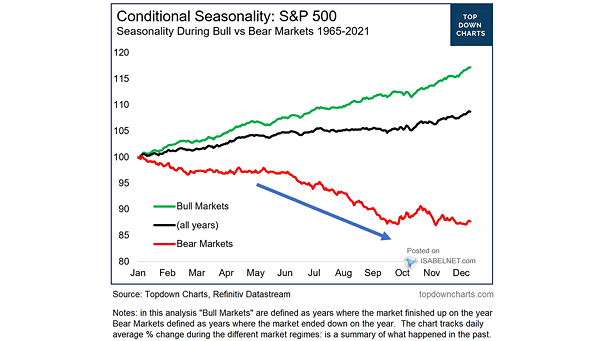

S&P 500 – Seasonality During Bull vs. Bear Markets

S&P 500 – Seasonality During Bull vs. Bear Markets The sell-in-May effect may be more relevant in bear markets. In bull markets, it may be seen as a missed opportunity for potential gains, given the positive momentum and upward trends typically observed in the market. Image: Topdown Charts