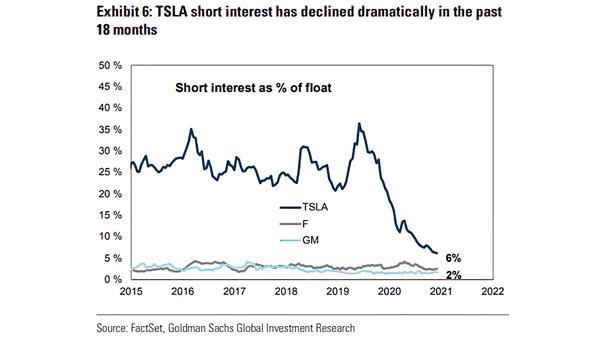

Average Short Interest as a Percentage of Free Float for Top 25 Most Shorted Stocks

Average Short Interest as a Percentage of Free Float for Top 25 Most Shorted Stocks Short-interest in most-bet against Russell 2000 stocks is declining, but remains high. Is more volatility coming? Image: Bloomberg