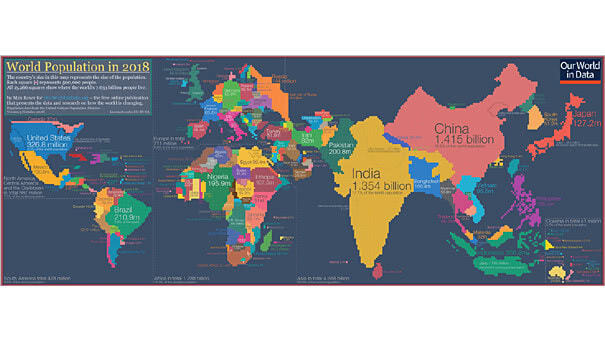

World Population in 2018

World Population in 2018 Interesting world map: the country’s size represents the size of the population. You may also like “World Population & Demographics – More People Over 65 than Under 5 for the First Time.” Image: Our World in Data Click the Image to Enlarge