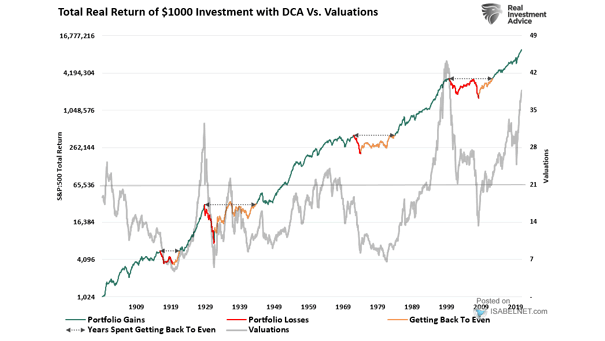

Total Real Return of $1000 Investment with Dollar Cost Average vs. S&P 500 Valuations

Total Real Return of $1000 Investment with Dollar Cost Average vs. S&P 500 Valuations Diversification does not always work and valuations matter. The S&P 500 can take a very long time to recover from a bear market. Image: Real Investment Advice