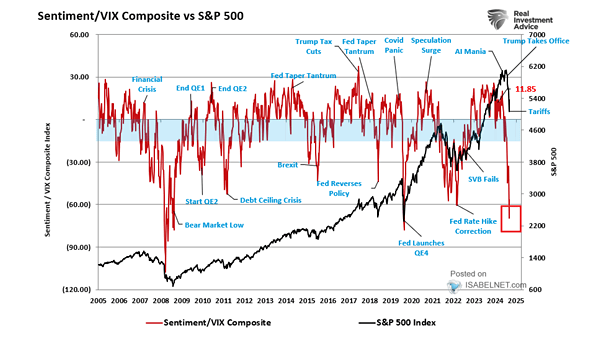

Sentiment/VIX Composite vs. S&P 500

Sentiment/VIX Composite vs. S&P 500 Bullish sentiment has experienced a significant reversal. Historically, elevated levels of optimism among retail investors and low volatility in financial markets have frequently indicated short-term market peaks. Image: Real Investment…