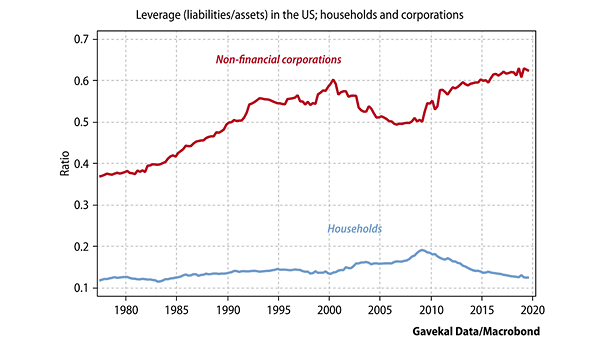

Leverage in the U.S.: Households and Corporations

Leverage in the U.S.: Households and Corporations This chart shows the divergence between U.S. non-financial corporations leverage and households leverage. U.S. corporation debt reached a record level of $10.12tn. Image: Gavekal, Macrobond