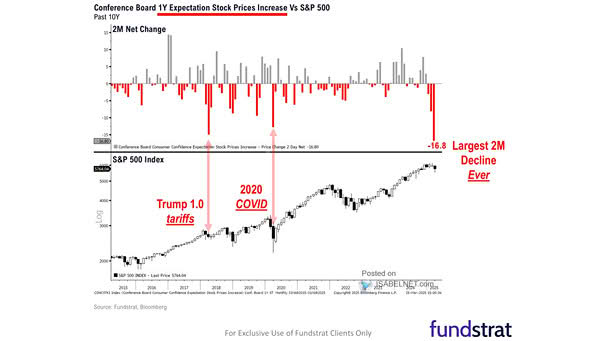

Conference Board 1-Year Expectation Stock Prices Increase vs. S&P 500

Conference Board 1-Year Expectation Stock Prices Increase vs. S&P 500 The Conference Board’s latest Consumer Confidence survey reveals the sharpest two-month drop in stock market expectations—a level of pessimism that historically signals a contrarian buying opportunity. Image: Fundstrat Global Advisors, LLC