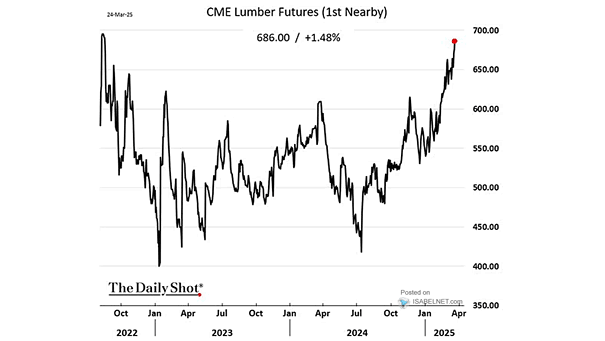

Housing – CME Lumber Futures Price

Housing – CME Lumber Futures Price The combination of increased tariffs, supply constraints, and strong demand is creating a challenging environment for the lumber market, leading to significant price increases that are expected to continue throughout the year. Image: The Daily Shot