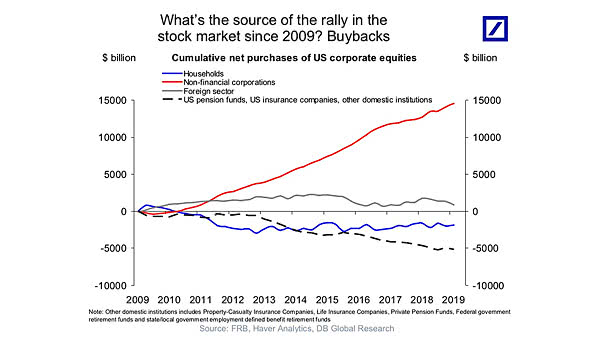

Buybacks Are the Source of the Rally in the Stock Market since 2009

Buybacks Are the Source of the Rally in the Stock Market since 2009 But as trade tensions and economic slowdown worry U.S. firms, stock buybacks declined last quarter. Image: Deutsche Bank Global Research