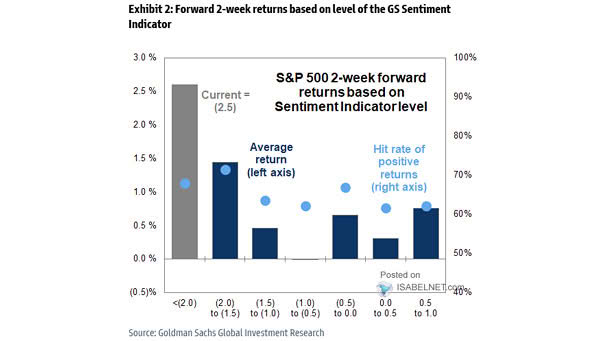

Average Forward S&P 500 Returns Following Large Declines in U.S. Equity Sentiment Indicator

Average Forward S&P 500 Returns Following Large Declines in U.S. Equity Sentiment Indicator When the GS sentiment indicator reaches such a low level, the S&P 500 typically delivers an average forward two-week return of approximately +125bps, with a positive hit rate of 70%. Image: Goldman Sachs Global Investment Research