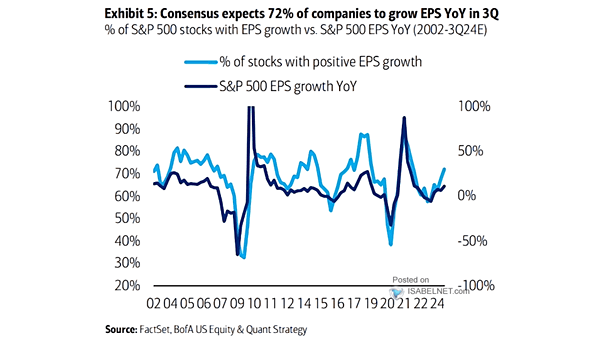

S&P 500 EPS Growth

S&P 500 EPS Growth Consensus estimates suggest that 72% of S&P 500 companies are projected to report EPS growth in 3Q24, reflecting a broader trend of improving earnings outlooks across various sectors. Image: BofA US Equity & Quant Strategy