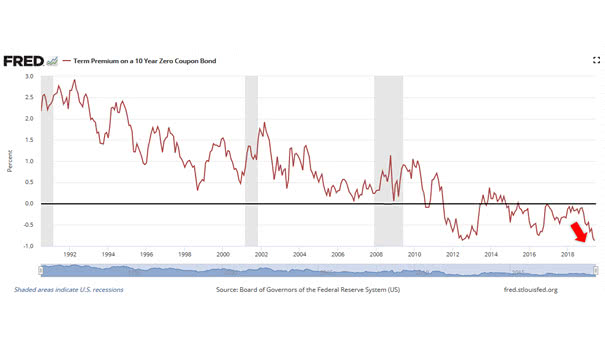

Term Premium on a 10-Year Zero Coupon Bond

Term Premium on a 10-Year Zero Coupon Bond Term premium on a 10-year zero coupon bond remains in negative territory. Investors do not seem to fear rising rates over the long-term. The term premium is the risk premium (or the bonus) that investors receive for the risk of owning longer-term bonds.