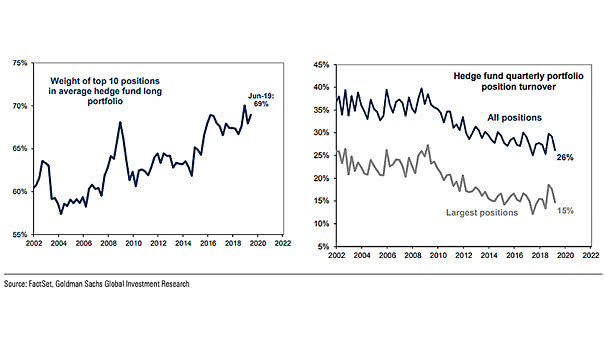

Hedge Fund Portfolio Density and Turnover

Hedge Fund Portfolio Density and Turnover Hedge fund portfolio density has steadly increased, and fund turnover has declined over the past decade. High concentration risk can lead to high losses and affect the financial system. Image: Goldman Sachs