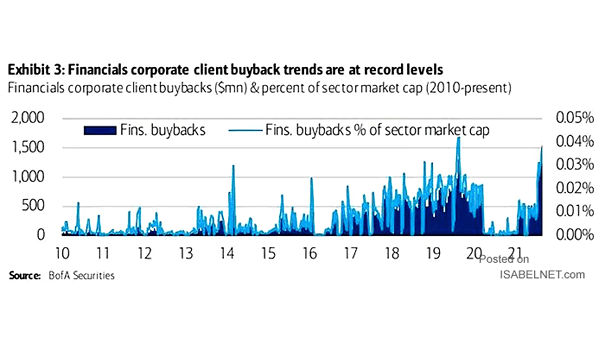

Financials Corporate Client Buybacks and Percent of Sector Market Capitalization

Financials Corporate Client Buybacks and Percent of Sector Market Capitalization Financials buybacks are booming, which is good news for financial stocks. Image: BofA Securities