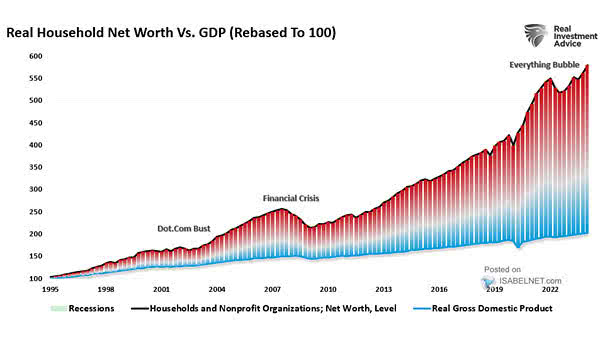

Real U.S. Household Net Worth vs. GDP

Real U.S. Household Net Worth vs. GDP The current wealth of American households, marked by an unprecedented gap between net worth and GDP, raises concerns about sustainability. A correction may occur if asset prices begin to realign with economic fundamentals. Image: Real Investment Advice