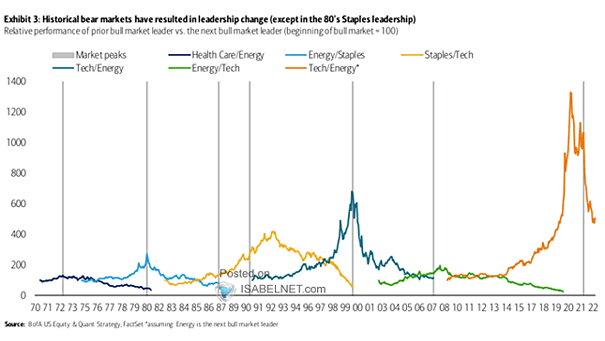

Relative Performance of Prior Bull Market Leader vs. The Next Bull Market Leader

Relative Performance of Prior Bull Market Leader vs. The Next Bull Market Leader Should investors continue to overweight the energy sector over the tech sector? Image: BofA US Equity & Quant Strategy